Cash Balance Pension Plans

- Home

- Cash Balance Plans

Cash Balance Plans for Small Business Owners

Boost Retirement Savings & Tax Benefits

Cash Balance Pension Plans (CBPs) offer a modern approach to retirement savings, combining the features of traditional Defined Benefit Plans with the flexibility of 401(k)-style accounts. These plans are increasingly popular thanks to their unique structure and benefits.

What Sets Cash Balance Plans Apart

Cash Balance Pension Plans provide a unique hybrid approach by blending the security of Defined Benefit Plans with the flexibility of defined contribution plans like a 401(k). This mix ensures predictable retirement benefits while offering the adaptability to customize contributions according to business or personal needs.

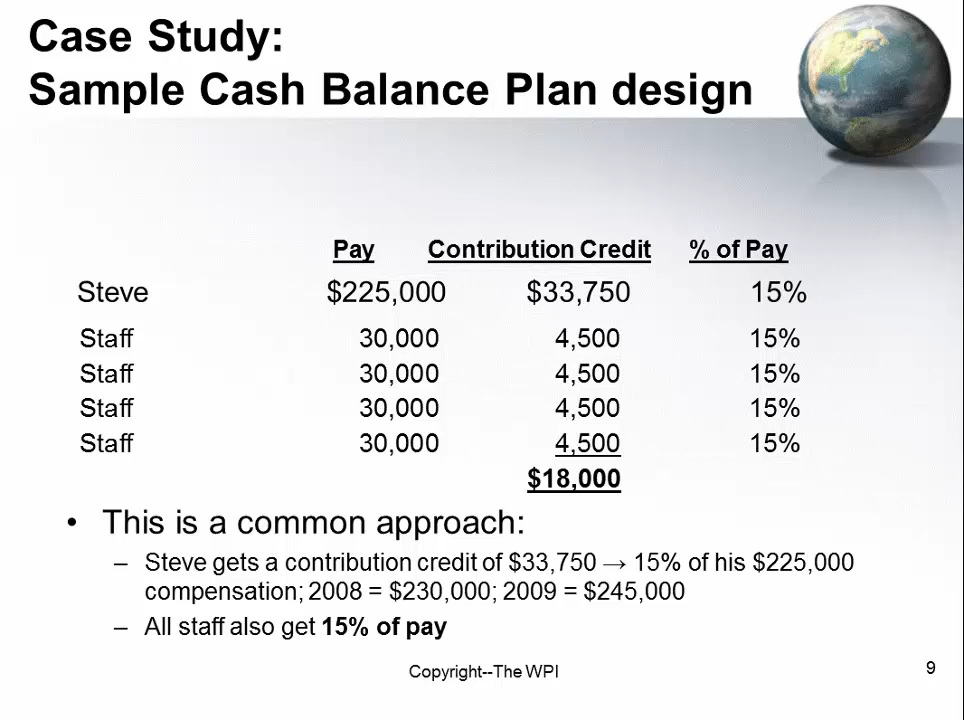

Each participant in a Cash Balance Plan is credited annually with a pay credit, typically a percentage of their salary, and an interest credit, which can be fixed or variable. This familiar structure offers clarity, mirroring the way individuals view their savings and investment accounts, thereby enhancing participant engagement and satisfaction.

Key Features of Cash Balance Accounts

Resembles a Profit Sharing Plan: A Cash Balance Plan is a Defined Benefit Plan structured similarly to a Profit Sharing Plan.

Flexibility Compared to Traditional Plans: Unlike traditional plans, which may offer fixed monthly benefits, a Cash Balance Plan allows for more flexible contributions and benefit structures.

Lump-Sum Retirement Funding: This plan funds a specific lump-sum amount for employees at retirement, which can be rolled into an IRA for greater control.

Transparency and Growth: Employees can see their account balance grow, providing a clearer understanding and appreciation of Cash Balance Plans compared to traditional Defined Benefit Plans.

Secure Your Future with Strategic Cash Balance Planning

If these concerns resonate with your current financial challenges, let us craft a tailored asset protection strategy for you. Contact us for a personalized consultation and discover how we can help you secure your wealth. Based in Fort Lauderdale, our team is deeply embedded in the South Florida community, offering solutions as unique as our clients.

Who’s elegible for a cash balance plan?

Recognizing who may benefit from a cash balance plan can help advisors evaluate who might be appropriate and help plan sponsors understand whether they qualify.

Top Earning Businesses and Professionals: Ideal for companies and individuals earning $275,000 or more yearly, seeking tailored retirement solutions.

Professional Service Firms: Suited for firms in accounting, law, medicine, and other professional sectors aiming to enhance retirement benefits.

Family-Owned and Mature Enterprises: Perfect for closely held businesses and senior business owners looking to maximize potential savings and plan for retirement.